Shayne Phillips, Director, Analytics Solutions at Anaqua

When it comes to innovating in green technology, corporations of all sizes, and ones that touch our world in various ways, are all striving to make a difference. Back in 2020 Anaqua conducted an analysis that looked particularly at small entities making a huge impact on the innovation of go-green technologies. Using Anaqua’s patent search and analytics tool, AcclaimIP, it was clear then that Small Entities—based on the United States Patent and Trademark Office (USPTO) definition of such—were perhaps playing an outsized role in the development of technology related to this planet and to our environment.

With Earth Day 2022 celebrating the theme of investing in our planet, it’s a great time to look at the intellectual property investments companies of all sizes are making in the diverse areas of green technology. This analysis picks up where the 2020 analysis left off, and was based on organizations filing and granting go-green related matters in the U.S. (with the search using established Cooperative Patent Classification (CPC) taxonomy terms for Climate Change-Related Technologies: Y02 and Y04S). Additionally, we have a further analysis from Philip Totaro, Founder and CEO of IntelStor, the preeminent cloud-based market intelligence ecosystem for renewable energy. IntelStor’s analysis of the green technology landscape looks at technology readiness levels, as well as the time to market and non-recurring engineering costs of relevant patented technologies. “Clearly electric vehicle and battery technologies have dominated the innovation market,” says Totaro, “but there has been a significant amount of pioneering innovation in solar photovoltaic, wind energy, and biomass-based fuel creation technologies as well, which has helped to significantly reduce the costs of those innovations.”

New Entrants to the Green Technology Top-Ranks

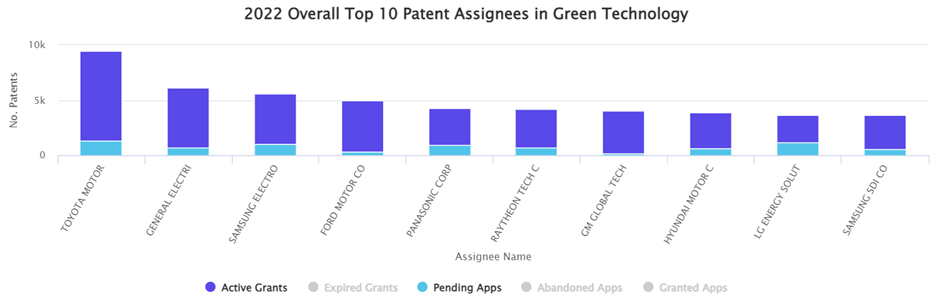

Before diving into the small-entity analysis from 2020 (and our 2022 small entity update), our past article also noted the top ten overall go-green U.S. filers/granters at that time in rank order as: Toyota, Panasonic, Nissan, State Grid Corp., Honda, GE, Robert Bosch, Toshiba, LG, and Hyundai. This year’s analysis shows a lot of entity movement into, out of, and within the top ten matter-holders in only two years’ time.

As was the case in 2020, Japan’s Toyota Motor Company continues to lead the way in green technology application filings and patents granted in the U.S., with almost 10K active U.S. grants or pending filed applications. General Electric saw its green energy-related IP holdings increase their position from number six to number two on the list. South Korea’s Hyundai Motor Company also moved up to number eight this year from number ten in 2020.

In particular, the absence of State Grid Corporation (as the only traditional energy technology provider represented in the former 2020 list), was noteworthy as they had championed electrical grid management technology, which is critically necessary in helping to facilitate the incorporation of renewable electricity generation sources into a conventional power grid. We give more insight into their absence, and into the lack of other traditional energy providers in the 2022 list further below in our analysis (see section entitled “IntelStor Brings Technology Readiness and Investment Insights into the Green Tech Conversation” for more information).

More U.S.-Based Companies Join the Top Ten List

New entrants to the 2022 top ten overall green energy filers/granters list were three U.S.-based companies: Ford Motor Company (4), Raytheon Technologies (6), and General Motors Company (7). South Korean electronics technology powerhouse Samsung Electronics Company Ltd. (3), and its subsidiary Samsung SDI Company Ltd. (10; which specializes in small-scale Lithium-ion battery, automotive battery, energy storage system (ESS), and electronic materials technologies) also joined the list.

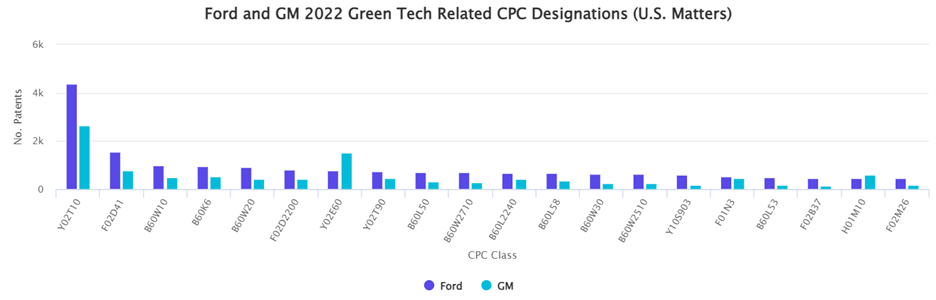

As a U.S. patent agent, it's a welcoming sight to see three new U.S.-based assignees make it into the top-ten list. They join lone 2020 list U.S.-based company, General Electric, onto the 2022 list this time around, making for four U.S. corporations now in the top ten green technology filers/granters listing. Ford and GM, unsurprisingly, are focusing their efforts on technologies geared towards making their piece of the transportation industry greener. Their matters are related to electronic control of traditional combustion engine technology (F02 CPC codes), hybrid and fully electric vehicle technology (B60 CPC codes), and automotive battery technology (H01 CPC codes).

U.S.-based Raytheon Technologies’ entrance into the 2022 top ten overall green technologies IP investors list could be attributed to the 2020 Raytheon Company merger with United Technologies Corporation. Indeed, 65% (2738 out of 4193 individual matters) of Raytheon Technologies’ go-green technology intellectual property was from United Technologies’ portfolio that had already been filed prior to the merger. The newly formed conglomerate’s particular focus on green technology relates to aircraft engine efficiency technology (B64 CPC codes), enhanced materials science technology (B22 CPC codes), gas turbine and jet propulsion technology (F05 CPC codes), steam turbine technology (F01 CPC codes), and 3D printing and materials joinery & manipulation technologies (B23 and B33 CPC codes).

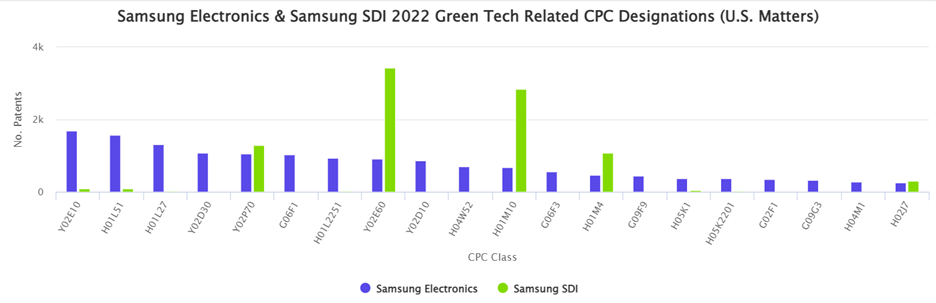

Samsung Sets its Sights on Green Technology

Samsung Electronics Company Ltd. and subsidiary Samsung SDI Company Ltd. made a big splash into the 2022 updated overall top ten go-green technology U.S. filers/granters list, coming in at ranks number three and ten, respectively. With a sharp focus on battery and energy storage technologies, Samsung SDI dominated in only a few green technology-related areas when compared to parent company Samsung Electronics. Samsung SDI focused heavily on areas related to greenhouse gas emissions reduction via their ESS technology (Y02E60 CPC code), fundamental battery improvement technology (H01M10 CPC code), and battery manufacturing technology (H01M4 CPC code). A few technologies being co-invented by both Samsung Electronics and Samsung SDI include climate change mitigation technology (as it applies to consumer products manufacturing; Y02P70 CPC code), and battery energy storage and discharge technologies (H02J7 CPC code).

Parent-company Samsung Electronics’ stand-alone green related technology IP filings were focused on technology for lowering greenhouse gas emissions from user displays (Y02E10 CPC codes), improved solid state device technology (H01L51 CPC codes), enhanced semiconductor technology (H01L27 CPC codes), as well as matters related to batteries for electric vehicles and energy storage, solar photovoltaic technologies, and electrical systems for power conversion.

Small Entities and Universities Continue to Have a Big Impact in Green Tech

Small-sized companies and even smaller micro-entities filing and prosecuting patent applications in the U.S. are given significantly reduced patent office fee structures by the U.S. Patent and Trademark Office (USPTO). This reduced financial burden is meant to help “level the IP playing field” between large corporations and smaller entities, and has led to positive intellectual property portfolio growth for highly technical companies (and universities). These small, micro, and university players continue to invest heavily in go-green technology development.

The 2020 small-players list was dominated by the University of California’s portfolio of almost 500 green-related active U.S. patent filings and grants. Their next closest small entity rival on the list, Korea Electronics and Telecommunications Research Institute (ETRI), had almost half the number of matters as the University of California in the 2020 analysis. Rounding out the top six small and micro entities from the 2020 study were Xyleco, Inc. (3), the University of Texas (4), King Fahd University (5), and the Korean Institute of Science and Technology (6).

Our 2022 update to the small and micro-entity green technology players once again highlights green-related technologies coming from entities out of the Asia-Pacific region, with the South Korean Government taking the top spot over 2020’s titleholder the University of California (which dropped to position number three in 2022). Spots two and four feature activity from the Government of China, while the final two spots for 2022 are held by two U.S.-based entities: Global Graphene Group of Dayton, Ohio, and Battelle Memorial Institute, headquartered in Columbus, Ohio.

1: Government of the Republic of Korea

2: The Central People’s Government of the People’s Republic of China

3: The University of California

4: Government of the Republic of China Taiwan

5: Global Graphene Group Inc.

6: Battelle Memorial Institute

Global Graphene’s rise to the top six small-entity green technologies list for 2022 is remarkable, with their company focused heavily on various aspects of the use of graphene – a common, two-dimensional substance made of carbon that is currently the strongest material to-date – (whether it be for graphene-based intermediates for consumer product performance enhancement, graphene-infused paints and coatings, or graphene for thermal control and management). But to me, the most exciting thing Global Graphene is doing in the green technology area with their expertise in all things graphene is in their development of next-generation Lithium-based batteries. Their ability to place protective layers of graphene sheeting at critical points in the battery body during production has now allowed manufacturers to create highly energetic, yet lightweight Lithium-metal batteries (rather than more traditional Lithium-ion batteries).

Battelle Memorial Institute’s focus in the green space revolves around enhanced fuel cell technology, and around the optimization and improvement of traditional electrical grid technologies. This latter technology focus is driven by their wholly owned subsidiary, the Battelle Energy Alliance. The mandate of the Battelle Energy Alliance is to not only push newer grid technologies forward, but to also improve and help bring about the next generation of nuclear-powered energy infrastructure. While nuclear energy isn’t “green” in the sense of renewable energy or solar power, it’s still a much cleaner source of energy production versus the coal-powered energy source utilized at many power plants today.

The remainder of the top go-green patenting small and micro-entity 2022 players focused their green energy technology development around wind power, solar power, fuel cell improvement technology, and next generation battery technology. With State Grid Corporation’s fall off of the 2022 overall green patentees’ list it was great to see these small entities fill in some of the gaps when it comes to traditional energy provider-related technologies, and to see their continuing efforts around making wind and solar energy generation more ubiquitous worldwide.

IntelStor Brings Technology Readiness and Investment Insights into the Green Tech Conversation

Excluding filings related to electric vehicles, recently filed green-related applications have centered on a few core areas of technology, namely hydrogen production, energy storage, electrical systems integration and “smart grid” technology, data science, and materials science. This shifting pattern has seen some of the more traditional players in the renewable energy and electricity markets, such as State Grid Corporation of China, drop down the IP rankings as small and medium sized entities (SMEs) have continued to grow in prominence (as was noted above in our section devoted to small entities and universities working in green technology related areas).

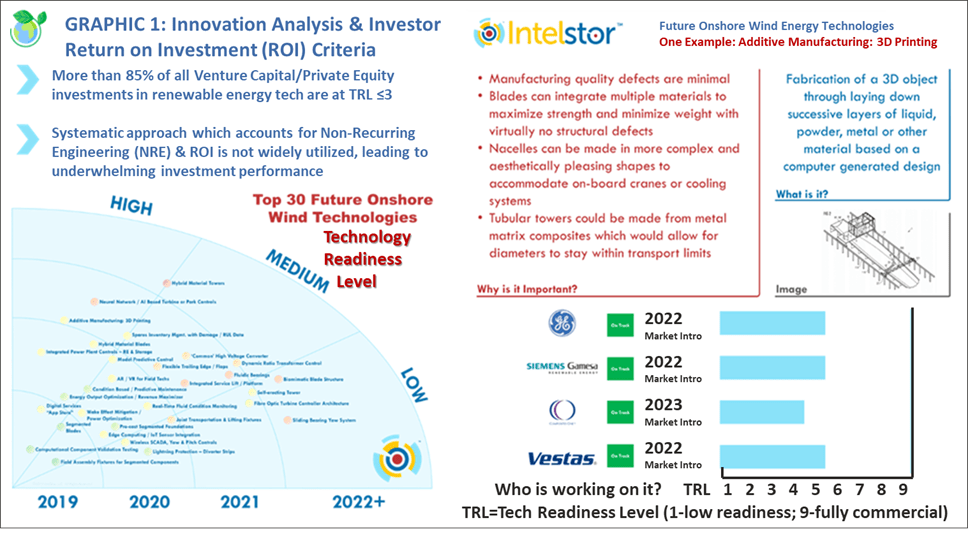

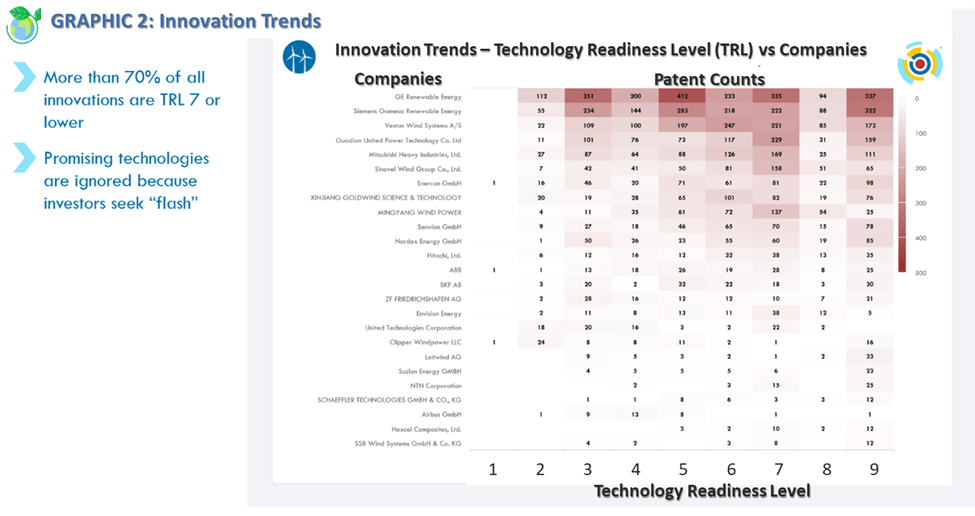

IntelStor, a cloud based market intelligence platform for renewable energy, conducted an analysis of a subset of these IP filings in the wind energy sector. The analysis reveals that, while a decent percentage of patents cover technologies which are commercially available, more than 70% of patent filings are related to defensive filings, or those innovations where the patent owner lacks sufficient commercial support to bring a product or service to market (which is based on the IP they captured in their filings). This trend reveals an important underlying issue around the need to improve the quality and return on investment (ROI) of IP capture, as well as a further need in ensuring a patented innovation has a route to market, so that the IP investment by a company is a fruitful one. Graphic 1 below looks specifically at 3D printing technology as it relates to Wind Energy, while Graphic 2 further illustrates the non-commercially ready nature of greater than 70% of the technology associated with Wind Energy generation.

Venture capital and private equity investors in SMEs have often looked for a bit more “flash” than substance with their investments, hoping to translate brand momentum into a profitable exit, whether the patented technology is closer to market or not. Much of their investing occurs in companies with patented innovations that are sitting at very low technology readiness levels, as this allows them to spread their bets on many new companies. However, without sufficient industry domain expertise they could easily miscalculate the cost and time to market for these promising new technologies, thus potentially jeopardizing their investments.

Funding miscalculations and money being “spread too thin” underscore the need to further incorporate more IP landscape data, benchmarking information, and evaluation metrics of the cost and time to market for green and renewable energy investments, all in an effort to improve the net present value and ROI of these critically important funding efforts.

Reflecting on the 2022 Earth Day Theme: Invest in Our Planet

Reviewing recent technology patents, as well as more established areas of green innovation, from companies working in so many different aspects of technologies that impact our planet, gives us much to be hopeful about. There are countless large companies, universities, and small entities working hard to make our environment and our world better for future generations.

Small companies and universities worldwide are just as invested in green technology as large corporations and the investment community. Together, companies of all sizes are creating an important and necessary balance that ensures the power to enact positive, meaningful change will rest in all of our hands moving forward from here.

If you would like to learn about these and other patents, contact us for a demo of Anaqua’s AcclaimIP patent landscaping and analytics tool. Request a free trial, or just ask us about our favorite recent discoveries in the world of Green Technologies.

Read more green energy IP technology analysis in this IAM Magazine article

Lecture complémentaire